2023年的物流状态报告:伟大的物流再保险set

The latest report says that the era of building supply chains solely around cost-reduction considerations is over. Rather, a new value has taken hold—resilience.

When authors of the 34th Annual State of Logistics Report” on the U.S. business logistics industry were doing their final research, they thought “Revenge of the Shipper” might be an accurate title to reflect the mood of the market.

They passed on that one.

Instead, they settled on “The Great Reset,” a title that paints the picture of a rapidly changing logistics environment in sharp contrast with the pandemic-affect years of 2020-2021. Last year’s report found that supply chains were largely still “out of sync” from the effects of the pandemic—but those days are over.

“Concessions that were given during the pandemic are getting clawed back,” says Marc Althen, a senior executive at Penske Logistics.

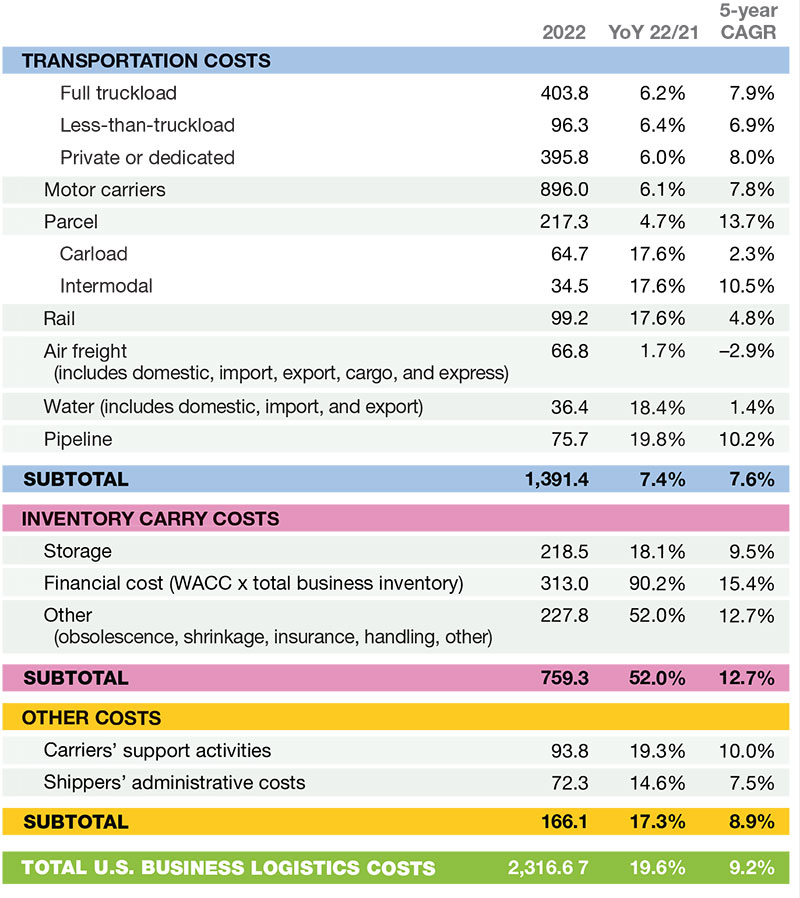

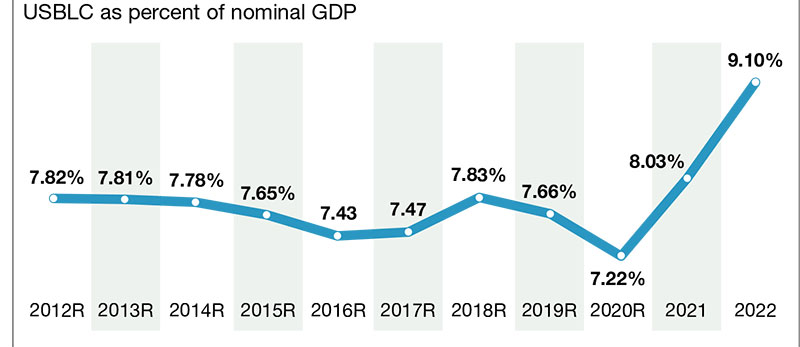

According to the new “State of Logistics Report,” U.S. business logistics costs soared to $2.3 trillion over the course of 2022, growing 19.6% from 2021 and now representing 9.1% of the nation’s gross domestic product (GDP). That’s the highest percentage of cost compared with GDP in the deregulated era. It was 7.5% of GDP just two years ago.

The 34th annual project of theCouncil of Supply Chain Management Professionals (CSCMP)includes findings from consulting firmA.T. Kearneyand industry partners Penske Logistics, LaserShip, Coca-Cola, Leaf Logistics, Kodiak Robotics, Morgan Stanley, and the Federal Reserve Bank of Cleveland.

It’s now becoming increasingly clear that shippers and carriers are united by a need to think more collaboratively and proactively about building new “strategic capabilities,” the report states.

However, such agility can’t be achieved overnight. Rather, it takes lengthy planning and extensive resources as well as top level executive commitments from the C-suite. “It takes money,” say the report’s authors. “It takes time.”

The USBLC increased 19.6% YoY between 2021 and 2022 ($ billion)

Contrary to past years’ double-digit growth year over year (YoY), supply chain demand is “likely” to remain stagnant or possibly diminish this year because of “lingering” uncertainties in both U.S. and global markets. GDP growth was a modest 3.1% worldwide last year, according to the International Monetary Fund, which forecasts 2.9% growth this year.

The latest State of Logistics Report says that the era of building supply chains solely around cost-reduction considerations is over. Rather, a new value has taken hold—resilience. But the best ways to achieve that resilience are not always obvious. “They often involve trade-offs among core priorities such as speed, service, optionality and savings,” the report says. “These calculations are only becoming more complex and nuanced with time.”

2022 mode by mode

Taken by mode, the trucking industry remains the engine that drives the U.S. logistics market. Here’s a modal summary of how U.S. business logistics costs rose by 19.6% between 2021

and 2022.

- Trucking costs rose to $896 billion, up 6.1% YoY and 29.3% from 2020. Full truckload was the largest sector at $403.8 billion, up 6.2% YoY and 28.8% from 2020. As capacity increased, spot rates tanked. “Carrier margins were threatened by low rates and high resource costs with smaller carriers—reliant on the spot market—under particularly acute pressure,” the report says.

- Rail costs were $99.2 billion, up 17.6% YoY and 33.1% from 2020. While rate hikes boosted railroads’ income and revenue, rising costs undermined bottom lines. The sector “also suffered from service-related issues, including increased terminal dwell, congestion, lagging network speeds and some high-profile derailments,” the report says.

- Parcel rose to $217 billion, up just 4.7% YoY and 20.1% from 2021. “Explosive growth in e-commerce at the height of the pandemic has returned to pre-COVID levels as shoppers returned to stores,” the report says, hinting at possible implications down the road for parcel giants UPS and FedEx.

- Air freight was flat, with $66.8 billion in domestic revenue last year, barely above $65.7 billion in 2021. Worldwide air cargo revenue is projected at $150 billion this year, 25% below 2022’s levels. One bright spot is fuel costs declined 20% from April 2022.

“In 2022, the market swung back sharply in shippers’ favor, a trend that has largely continued during the first half of 2023. Across all modes of transit, shipper demand and carrier capacity have rebalanced,” the report’s authors conclude. “Inventories are ample, and the quirky demand spikes of the quarantine era have leveled off for now.”

Time to fine-tune is now

Savvy shippers are advised to fine-tune their logistics strategies now. What’s worked to survive the pandemic-era years may no longer be the best approach now, says the report.

“The 2023 ‘shippers’ market will come to an end in during the fourth quarter of this year and into the first quarter of 2024, and no shipper should be caught off guard unless they’ve ignored the needs and opportunity to improve their capabilities and their ‘shipper of choice’ behaviors,” says Rob Haddock, group director, transportation strategy at Coca-Cola North America.

9.1% represents the highest percentage of cost compared with GDP in the deregulated era

The volatility of the freight market is even affecting longstanding, day-to-day activities of logisticians and supply chain experts. Even the annual bidding process for carrier services is being threatened, the report says.

The annual bid, which has traditionally given both shippers and carriers a base of certainty for capacity and rates, has in many cases been recast as “just another component” of how shippers engage with carriers, third-party logistics providers and forwarders, rather than the definitive last word. “Mini-bids and more frequent touch points are becoming the norm as shippers look for closer market engagement,” the report says.

So where does that leave the carriers? Well, scrambling to find decent-yielding freight that fits into their increasingly complex national and international networks. “There’s no denying that most freight haulers are indeed in a tight spot,” the report concludes rather coldly.

One avenue is for carriers to more actively seek to become true strategic partners to shippers, doubling down on such qualities as reliability, visibility and comprehensiveness of service. Some large carriers are looking to do this by offering turn-key “4PL” capabilities.

However, the report says that there’s an even larger development forming between shippers and carriers alike—and suggests they may have more common ground than either realizes. “That development is the major shift in the role of logistics itself across the entire economy,” say the authors.

Before the pandemic, logistics was still largely considered a side function. No more. “Now it’s widely seen as a core determinant of service and revenue outcomes, and a strategic differentiator,” the authors conclude.

报告的反应

Reaction from a panel of experts assembled for a media session ahead of the report’s official release was generally positive. However, one area that caught some by surprise was the impact on the huge spike in inventory carrying costs.

Inventory and carrying costs associated with storage of goods zoomed last year, mostly because of higher interest rates. Financial costs of business inventory climbed to $313 billion last year, up a whopping 123% from 2021. Product obsolescence and insurance costs more than doubled as well to hit $227 billion last year. Overall inventory costs were $759 billion, up nearly 400% from 2021 levels.

Paul Bingham,director of transportation consulting forS&P Market Intelligence, says the spike in inventory carrying costs was unusual. “That changes the equation for some big companies trying to manage inventory when you have carrying costs shooting up so much,” he says. “I would focus on that as an area to watch.”

Bart De Muynck, chief industry officer for project44, says that logisticians must be prepared to act after “micro” climate events affect supply chains. “Companies need to be very flexible and agile in looking at how we respond to those events,” he says. “Unfortunately, that’s something we’re only going to see increasing—the numbers of these disruptions and how they disrupt supply chains.”

That resiliency among logisticians was noted by several of the panel members. “The top trend in the report is resilience,” says Greg Javor, Mattel’s global supply chain chief of operations. “It’s really aligning the internal stakeholders with what logistics is going to be. We’ve worked a lot on defining what that’s going to be.”

As air freight carriers struggle to regain market share after demand plummeted during the pandemic, carriers must take a worldwide perspective, Javor adds. “Given that a lot of our manufacturing is throughout Asia, the inventory piece is like the circulatory system of our supply chain,” he says. “It gets a lot of attention.”

Robert Walpole,vice president of air cargo forDelta Air Lines, says the rate of change in worldwide air cargo rates toward “normalization” was encouraging. “Inventory, rates and capacity normalization has really been a surprise,” he says. “It’s maybe six months to 12 months faster than we would have expected as an industry. All supply chains need to adapt to that, and it is potentially good news for manufacturers and customers because supply will exceed demand for a good amount of time.”

Trucking costs—insurance, driver wages, equipment among them—are increasing relentlessly. Shippers are advised not to expect too much break in their contract renewals with carriers.

As examples of how costs are increasing across all modes, West Coast dockworkers recently won a 32% pay increase through 2028. FedEx’s pilots won a 30% tentative increase, while pilot pay at Delta will be rising 34% over the next four years.

“Carrier costs significantly exceed spot market rates,” saysAndy Moses, Penske Logistics’ senior vice president of sales and solutions. “The underlying cost of trucking is not declining. So, carriers are upside down. Capacity is exiting the market.”

All that points to a firming up in trucking rates and “probably an increase in rates” later this year and into 2024 Moses predicts.

Article Topics

A.T. Kearney News & Resources

2023年的物流状态报告:伟大的物流再保险set State of Logistics 2021: Full speed ahead U.S. business logistics costs fall 4% in pandemic year of ‘chaos,’ new study finds 28th Annual State of Logistics: Into the great unknown State of Logistics 2016: US Business Logistics Costs Slow Considerably with 2.6% Growth A.T. Kearney analysts see shift in procurement strategiesLatest in Logistics

Are we trending towards a ‘normalization’ in supply chain and logistics? 2023年的物流状态报告:伟大的物流再保险set 2023 State of Logistics: Third Party Logistics (3PL) 2023 State of Logistics: Air Cargo 2023 State of Logistics: Ocean cargo 2023 State of Logistics: Rail/Intermodal 2023 State of Logistics: Truckload 莫re LogisticsSubscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

July 2023

万博2.0app下载

Latest Resources