30th Annual Study of Logistics and Transportation Trends: Talent and Technology

Our annual survey reveals that logistics is no longer just a cost of doing business. Today, it’s the source of strategic innovation and an essential part of how organizations are competing and preparing for an unpredictable tomorrow.

In 1991, the first year of the “Annual Study of Logistics and Transportation Trends (Masters of Logistics)” study, the top grossing movie was “Terminator 2.” The movie depicted a future of conflict between man and machine. Now, 30 years later, this future is much easier to imagine, as rapid technological advancements are driving and enabling changes to the way we all live, work and conduct business.

Technology is also enabling and driving changes to the ways companies move, store and deliver goods and services. The “30th Annual Study of Logistics and Transportation Trends (Masters of Logistics)” endeavored to gain insights into the impacts of these changes as well as how technology and other factors are impacting and shaping the “human” aspects of logistics and transportation. Results from this year’s study revealed some interesting trends that we are excited to share.

Strategic shifts

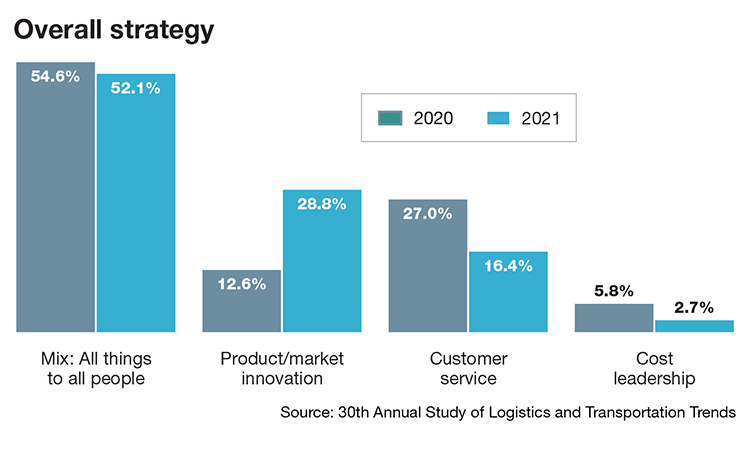

For many years, the annual study has included questions related to organizational strategy to gain insights into the key forces guiding and driving logistics and transportation decisions. As in previous years, most respondents (55.9%) describe their overall strategy as being a mix between balancing cost and service objectives.

However, an increasing number of respondents indicated a strategic focus on product and market innovation. We believe that this is a significant and potentially pivotal change that highlights an evolution in logistics and recognition of the opportunities and value of logistics and

transportation centered innovations.

Our understanding of logistics and its importance has certainly evolved over the years. However, many logistics processes continued to rely on manual and analog processes. While these processes generated a great deal of data, it was rarely used or fully leveraged. This is changing rapidly.In the past, logistics was viewed as simply a “cost” to be minimized or a target for “efficiency” focused efforts. This perspective overlooked the importance and potential of logistics. In fact, the management consultant and author Peter Drucker referred to logistics as the “economies dark continent,” and suggested that “we know little more about distribution today than Napoleon’s contemporaries knew about the interior of Africa. We know it is there, and we know that it is big; and that is about all.”

Today, logistics and transportation operations and organizations are leveraging data and harnessing innovative technologies to gain efficiencies, automate processes, enable new business models and improve supply chain visibility and flexibility.

Logistics is no longer just a cost of doing business. Logistics is now a source of strategic innovation and an essential part of how organizations are competing today and preparing for an unpredictable tomorrow.

Operational shifts

Our study also sought insights into any strategic shifts in the primary objectives occurring at the specific division or business unit level. Similar to last year, increasing customer satisfaction and maximizing profitability were the two top operational level objectives.

然而,我们的研究结果显示另一个有趣的trend, with 20.5% of respondents indicating that their primary operational objective was “maximizing asset utilization.” This is a more than 8% increase from 2020, while we saw a significant decrease in those with primarily a cost reduction focus, down over 13%.

We believe that these results are reflective of the strong demand for transportation thus far in 2021, with carriers operating at or near capacity. As a result, carrier costs and rates have increased and prompted a strategic focus on innovation to maximize and derive value from assets.

We believe that these efforts were further reflected in participant’s responses when asked to rate their company’s performance in five key areas relative to their major competitors. On four of the measures—firm profitability, competitive position, customer satisfaction and revenue growth—respondent performance decreased relative to 2020. Only return on assets improved relative to 2020, showing a 4.5% improvement).

这项研究还指出操作层t的变化erms of how transportation is procured. First, 2021 wasn’t quite as dystopic as 2020, but last year we saw significant changes in how goods were moved to market and may be a reflection of our new normal. These types of operational decisions should reflect on how strategic initiatives are being implemented.

Interestingly, the use of dedicated fleets and intermodal had the largest positive percent changes by respondents. Use ofless-than-truckload (LTL)andtruckload (TL)also increased, while use of private fleets continued to decline. Small package/surface package both declined, perhaps an indicator that the COVID jolt of early 2020 was managed more effectively with the passage of time and normalization of the markets.

Second, transportation services are being procured by shippers using a variety of methods, from traditional contracts to app-based truck brokerage. Given these choices, it’s interesting to note the continued role and influence of technology on the procurement of transportation.

最值得注意的趋势是预期的增加reliance on contracted services and digital loadboards. To compare the absolute increase of usage for each choice, the percent of respondents who reported using less of a service were subtracted from those that said their use would increase.

例如,13.6%的被调查者报告they were using less contracted services and rates with carriers, but 54.5% of our respondents reported an increase, with a net positive increase of 40.9%. Year-over-year growth was greatest for loadboards and technology enabled brokers.

Factors influencing technology adoption

There is one clear message from our respondents: technology in transportation matters.

We’re currently surrounded with technology options, and vendors are craving adoption by carriers and shippers. When asked about the motivations for recent technology adoptions, 87.5% of our respondents indicated the technologies were necessary to compete in the marketplace.

Nearly 72% of respondents indicated the number of different technologies required to work with customers was increasing, with 62.5% indicating that they believed that they would lose a customer to a competitor if they did not adopt a specific technology. These results further verify the increasingly important role of technology within our discipline.

However, there were a notable number of respondents indicating the costs of adopting these technologies is greater than the benefits (24%); that it was costly to maintain and supporting the new technologies (43%); and that the costs and time required to train employees to use the new technologies was high (52.4%).

Logistics talent

Much has been written about obtaining, training and retaining employees, but our results highlighted a gap worth sharing.

Respondents were asked what factors were most critical in an ideal work environment, and it was no surprise that compensation was ranked as most important—as is having a good boss, company culture, and feeling appreciated.

The second most important factor on the list was opportunities for career growth and development, a finding that’s consistent with feedback we

frequently receive through interactions with graduate and undergraduate students and job seekers.

Fortunately, over 40% of respondents agree/strongly agree that their organization has a formal training program for new hires. The bad news is that 23% indicated their organization does not have a formal training program or clear development path.

We believe that this represents a significant and valuable opportunity for logistics and transportation companies to better attract and retain the human talent needed to continue innovating and propelling logistics forward.

Remembering Mary Holcomb

As we conclude the “30th Annual Study of Trends in Logistics and Transportation (Masters of Logistics), we want to recognize and remember our dear friend and an original author of this study, Mary Holcomb. Mary passed away suddenly earlier this year. She was an incredible academic and an even better person, and we will miss Mary deeply and remember all the laughs and wonderful times we shared.

Much like movie sequels, the annual study will continue, but with some new characters and players. The goal will be the same: to provide readers with a different and insightful perspective into the world of logistics and transportation. A special thanks to all of the Logistics Management readers who have supported us, encouraged us and made us better.

Article Topics

Motor Freight News & Resources

As Yellow and the Teamsters remain at odds, LTL market is left with a fair share of questions to answer Yellow is taking the Teamsters to court over breach of binding union contract Echo’s Hurst takes a look at key logistics and transportation trends at SMC3 Connections National diesel average falls, for the week of June 26, reports EIA New BlueGrace Logistics Index highlights industry sentiment for Q3 inventories, revenues, and orders Breakthrough’s new study focuses on key shipper and carrier goals over the next 12 months FTR’s Trucking Conditions Index shows modest improvement while long-term issues remain intact ios万博体育app下载Latest in Logistics

As Yellow and the Teamsters remain at odds, LTL market is left with a fair share of questions to answer Delivering a performance edge to warehouses, distribution and fulfillment centers SMC3 panel examines ways of managing and operating through risk-based events Manufacturers are up against AI, workforce productivity and innovation speed challenges Yellow is taking the Teamsters to court over breach of binding union contract Echo’s Hurst takes a look at key logistics and transportation trends at SMC3 Connections Future-Proof Your Supply Chain with Best of Breed Yard Management and Dock Scheduling More LogisticsSubscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

June 2023

万博2.0app下载

Latest Resources